Donate Securities & Mutual Funds

A powerful way to make your generosity go further.

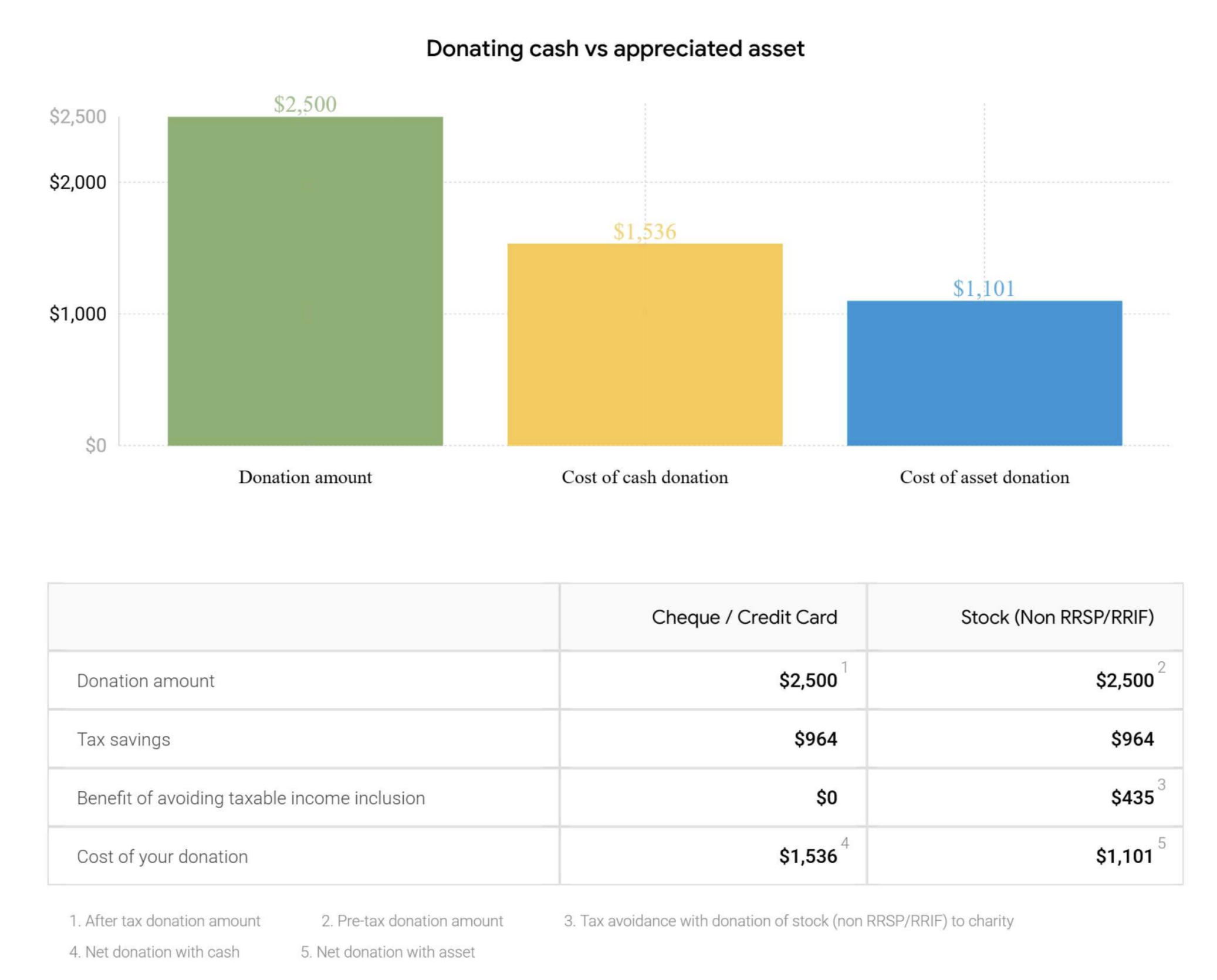

Donating publicly traded securities or mutual funds is one of the most tax-efficient ways to support Hamilton Music Collective—and one of the most impactful.

When you donate securities directly, capital gains tax does not apply. This means HMC receives the full fair market value of your gift when the security is sold, and you receive a charitable tax receipt reflecting that larger contribution. In short, your gift goes further!

Your donation helps us provide free, high-quality music education to children and youth across Hamilton—removing financial barriers and opening doors to creativity, confidence, and lifelong learning.

Why donate securities?

- Avoid capital gains tax on appreciated assets

- Maximize the value of your charitable giving

- Receive a tax receipt for the full market value

- Make a meaningful, lasting impact on music education in our community

We’re here to help

Donating securities is easier than you may think, and our team is happy to guide you or work directly with your financial advisor. We recommend donating via LinkCharity, or by contacting us for other options.

You can learn more about the benefits of donating securities and mutual funds at CanadaHelps.